All That Glitters…

If you’ve been waiting to buy gold, this might be the moment. Gold prices have fallen 8% in the last several weeks. The downward glide seems to have halted, which is comforting to some. Jewelers are considering whether it might be the moment to stalk up. But so far, nobody knows.

If you’ve been waiting to buy gold, this might be the moment. Gold prices have fallen 8% in the last several weeks. The downward glide seems to have halted, which is comforting to some. Jewelers are considering whether it might be the moment to stalk up. But so far, nobody knows.

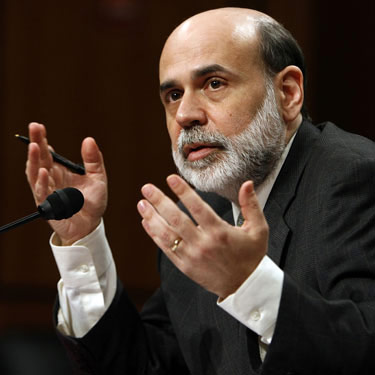

And why? Let’s look at the basics. In the past week, the venerable Ben Bernanke, Federal Reserve Chairman and a key architect of any recovery that might be underway, said that he expects the economy to continue its painful twists and turns without hint of recovery until 2010. That’s a departure from the past, when he said to expect the turn-around to begin in late 2009.

Not only that, but we’re also seeing signs of deflation. Retailers are being hit so hard that they are dropping prices in desperation. Some of those prices may force them finally out of the market. Car dealerships, in particular, are struggling with the rules of car-buying now undertaking serious rewriting. It’s a great time to be in the market for a new car.

But what about gold? Gold almost always holds its value. And although it has slipped a bit, the determination of whether to buy or sell has always been a personal one. If you are finding yourself with additional cash, investment gold might be a good place to stash it. If you are needing some cash, and have some extra gold, this is as good of a time as any to sell it for its value. And if you don’t have a lot of cash, well, then let me steer you towards some of the rings and earrings on this website, which are particularly good values!

The decision to buy, sell, or stay out of the market must always be made in a careful way with consideration given to the personal situation at hand. And this time, like every other difficult economy, we will all need to keep that at the forefront of our thinking.

Category: Gold Prices