Bitcoin, Crypto On the Move, Tech Correction, Oil & Energy to Come

Bitcoin is on the move, breaching $60,000 and then quickly nearing $62,000 this weekend, with crypto investors holding firm. With several sudden sharp inclines in bond yields, Tech stocks took a real correction mid-February. Concerns of inflation dampen short-term outlooks on Tech, except for niches within niches like Honeywell or RIOT Blockchain that are not only heavily invested in software, but also in growth sectors like industry and aerospace or cryptocurrency infrastructure.

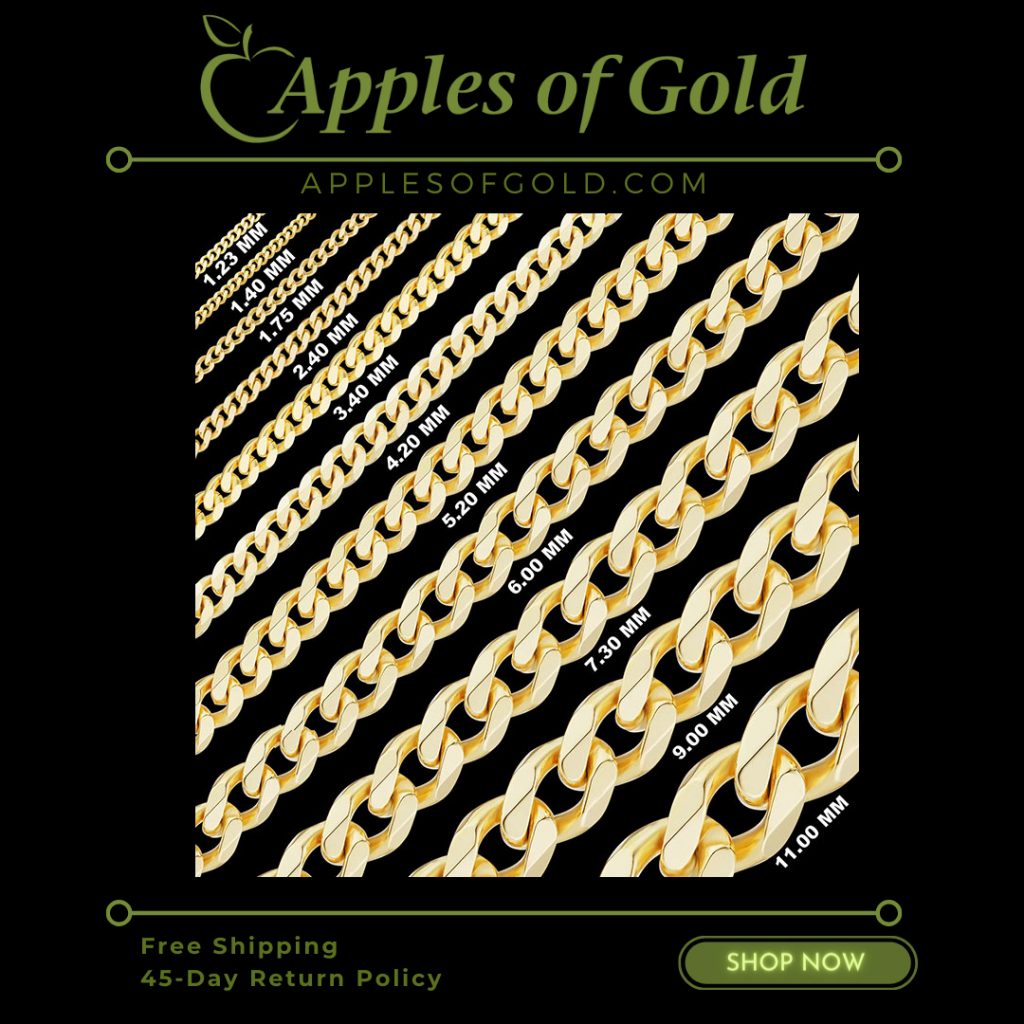

Gold is certainly good to have in your portfolio also. When I first founded Apples of Gold Jewelry, gold was valued at somewhere in the $287 per ounce range. It recently fell from its recent $1,900+ average to just below $1,700 where it hovers today.

With fears of inflation, and numbers being released Mid-April and again in each consecutive month, I believe Tech stocks are now at risk of having several corrections in the Spring. This will potentially create a great buying opportunity for those who have held cash on the sidelines waiting for the next big dip, with modest margins at the helm.

Tesla seems to be a part of every investment portfolio—or should be, even with its inflated share price, but we all know that Tesla is not just a car company, and with engineering rock star Elon Musk at the helm, it’s just a solid investment at almost any price, if held for the long term.

But beyond all the buzz and glamour of tech, crude oil, energy and industrials and materials are quietly about to make a major comeback (at least in the short term), as economies and States re-open and recover from the tyranny of government lockdowns and cessation of industry and business. By the Summer, most States are likely to mostly re-open, even begrudging ones like WA State with its dictatorial governor and bloated approach to Covid-19.

In other words, it’s time to reduce your holdings in tech until after the correction passes, buy the dip, and diversify again into energy, industry, and innovative companies that have their footing in multiple sectors, to hedge against the near Wild West approach of investing that we’re witnessing lately.

Crypto should be, I believe, at least 10% of your total portfolio. Don’t under-estimate the vast potential, as institutional investors, payment gateways, and financial sectors increasingly take a large stake in not only Bitcoin, but the smaller coins that are also shooting upwards.

I’m not a professional investor or an advisor; if anything, like most retail investors, I’m along for the ride, and subject to the many market fluctuations, risks and manipulations always on the horizon. The greater fear, I think, is the longer term U.S. debt, printing of new money, inflation, and the political inanity of those in power.

WANT TO BUY CRYPTO? Join Coinbase and Earn Free Coins