Gold Up, Oil Down – How it Effects Jewelry Prices

Gold is up, oil fell below zero for the first time ever, 26 million Americans are unemployed, milk is being dumped by the tons by dairy farmers, some meat slaughterhouses have closed, our supply chains are overloaded. All of this spells tough times and economic challenges ahead. What does this mean for jewelry and gold prices?

Gold is up, oil fell below zero for the first time ever, 26 million Americans are unemployed, milk is being dumped by the tons by dairy farmers, some meat slaughterhouses have closed, our supply chains are overloaded. All of this spells tough times and economic challenges ahead. What does this mean for jewelry and gold prices?

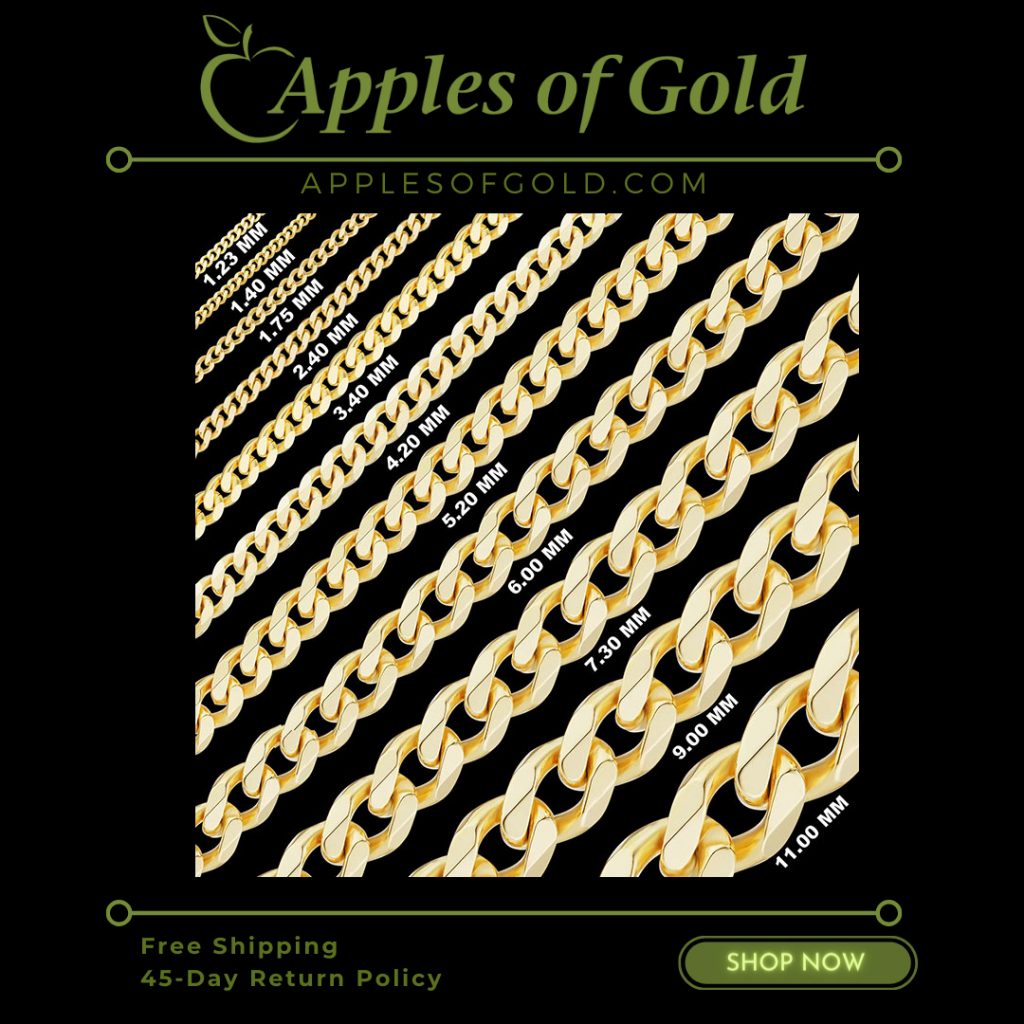

As of today, gold prices are $1,730 and some analysts believe it is ready to breach the $1,800 mark. This means modest price increases for gold-heavy items like gold curb chains, solid gold crosses, and items that normally have more gold content vs. jewelry that is more focused on stones, such as diamonds and gemstones. That’s if gold continues to see an uplift as confidence in the U.S. dollar and the economy diminishes. With president Trump’s stimulus package, this may hold the economy in check so that there is not a massive upswing in gold and jewelry prices, but so that the rise is moderate. But there is no question that unless things return to a semblance of “normal”, that gold and jewelry prices will continue to see modest increases.

To put this in perspective, a gold cross, for example, that weighed 8 grams and cost $600 before covid-19 when gold was hovering in the $1,500 range, would now cost $675 at today’s prices if jewelers are tracking and adjust prices to the gold market regularly, as Apples of Gold does. At $1,800 per ounce, the same cross would cost $700 (a modest increase from today’s prices). But if gold were to hit $2,000 per ounce, something that gold investors and collectors have been talking about for over a decade, would cost $775 (still a relatively stable increase if gold prices go up on the uprise slow and steady). Now with the new economic conditions after the world was hit with the coronavirus and what many people believe was an overreaction to the virus, gold prices are realistically poised to reach $2,000 within a relatively short time unless the country gets back to work soon and confidence in the economy resumes.

Platinum, on the other hand, has been staying steady or even going down, at times, and you should expect to see platinum jewelry prices decrease, if they have not already. Platinum has remained historically for many years now, however, and so prices may have already adjusted across many jewelry stores, such as Apples of Gold Jewelry.

Sterling silver crosses, for example, is also another precious metal category that should be largely unaffected by the current economic climate in terms of jewelry pricing, as it is already a relatively inexpensive metal and even a large fluctuation could mean minimal fluctuations in pricing when it comes to retail silver.

At Apples of Gold Jewelry, we remain committed to providing the highest quality jewelry at below retail pricing and have used this opportunity to increase sales and give our customers a better pricing in order to both increase sales and give our customers a better deal. With two of three of our main manufacturers and wholesale suppliers still operating during these challenging times, Apples of Gold is still able to function and provide both quality customer service and jewelry. We hope and pray that all of our jewelry suppliers will be back soon, so that we can be fully operational and stronger than ever!