Gold Standard – Part II

Last week we talked about the Gold Standard, which was when the United States government guaranteed each gold-backed American dollar in circulation.

Last week we talked about the Gold Standard, which was when the United States government guaranteed each gold-backed American dollar in circulation.

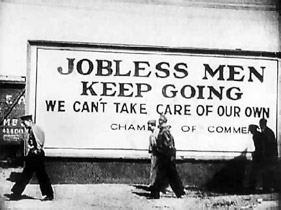

With the current economic contraction that is underway, some people are positing the notion that returning to the gold standard would help. But the reality is that the gold standard contributed to the Great Depression.

A currency is only as good as the government’s credibility that backs it up. Sticking with the gold standard? If a government goes on, then off, then on again,well, you can see that credibility is quickly lost. And historically, that is what countries have done.

In the years after World War I, many countries had suspended convertibility of gold during the war, and then stayed of gold. They experienced fiscal chaos as speculators moved in and wildly fluctuating monetary policies robbed citizens of stability needed to rebuild.

But counting on a gold standard, in a fiscally unstable market, when investors, speculators and citizenry doubt governments’ ability to keep to that standard was edging too close to the cliff.

International capital flows became more erratic, not less, as doubts were raised about whether first the pound, then the dollar.

Britain lost ground under these speculative attacks and released its gold standard in 1931. The U.S. toughed it deliberately raising interest rates in the same year, when the economy was already in near free fall. The resulting damage to the economy is well known.

The longer a country stuck to the gold standard, the more overall deflation it experienced. Many experts are persuaded that this deflation greatly added to the economic difficulties of those countries that insisted on sticking with a fixed value of their currency in terms of gold. It got worse, not better.

The bottom line is if buying gold is your standard for maintaining economic stability, then let it continue to be your standard. As for a return to the gold standard, that is unlikely and probably ill advised.